Problemas com frete internacional

março 7, 2022

Custos crescentes na fabricação de plástico

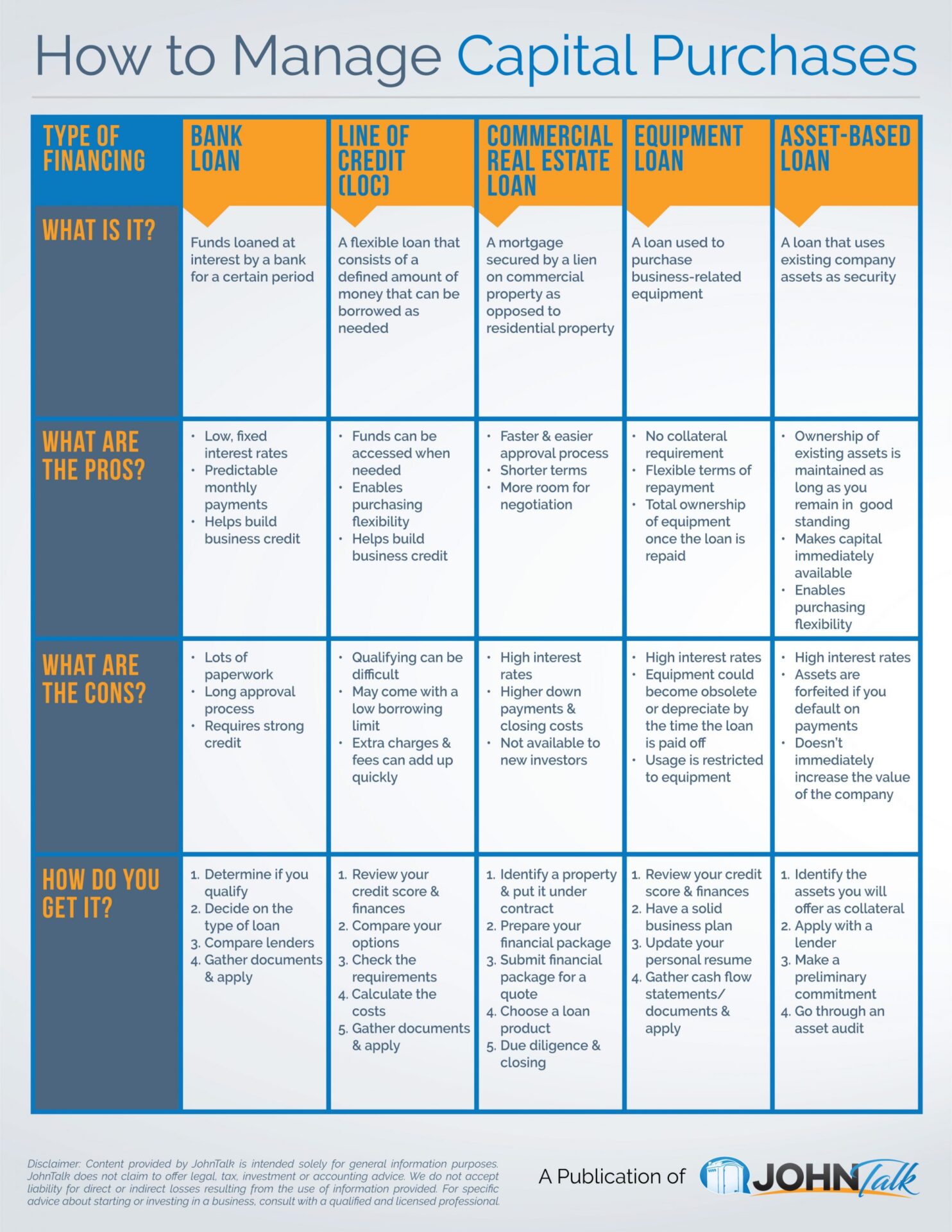

março 7, 2022À medida que você constrói e expande seu negócio de banheiros portáteis, precisará investir em equipamentos – unidades, pias, caminhões, talvez até terrenos e espaço de armazenamento. Dependendo do tamanho e da frequência dessas compras de capital, você provavelmente estará utilizando algum tipo de financiamento.

Que tipos de financiamento estão disponíveis? Qual opção ou opções fazem mais sentido para o seu negócio? Estas são as perguntas que queremos ajudá-lo a responder. Por isso, montamos este infográfico para servir de referência na hora de gerenciar as compras de capital para o seu negócio.

Gostou desse infográfico? Compartilhe com seus amigos e colegas!

How to Manage Capital Purchases

Bank Loan

What is it?

Funds loaned at interest by a bank for a certain period

What are the pros?

- Low, fixed interest rates

- Predictable monthly payments

- Helps build business credit

What are the cons?

- Lots of paperwork

- Long approval process

- Requires strong credit

How do you get it?

- Determine if you qualify

- Decide on the type of loan

- Compare lenders

- Gather documents & apply

Line of Credit (LOC)

What is it?

A flexible loan that consists of a defined amount of money that can be borrowed as needed

What are the pros?

- Funds can be accessed when needed

- Enables purchasing flexibility

- Helps build business credit

What are the cons?

- Qualifying can be difficult

- May come with a low borrowing limit

- Extra charges & fees can add up quickly

How do you get it?

- Review your credit score & finances

- Compare your options

- Check the requirements

- Calculate the costs

- Gather documents & apply

Commercial Real Estate Loan

What is it?

A mortgage secured by a lien on commercial property as opposed to residential property

What are the pros?

- Faster & easier approval process

- Shorter terms

- More room for negotiation

What are the cons?

- High interest rates

- Higher down payments and closing costs

- Not available to new investors

How do you get it?

- Identify a property & put it under contract

- Prepare your financial package

- Submit financial package for a quote

- Choose a loan product

- Due diligence & closing

Equipment Loan

What is it?

A loan used to purchase business-related equipment

What are the pros?

- No collateral requirement

- Flexible terms of repayment

- Total ownership of equipment once the loan is repaid

What are the cons?

- High interest rates

- Equipment could become obsolete or depreciate by the time the loan is paid off

- Usage is restricted to equipment

How do you get it?

- Review your credit score & finances

- Have a solid business plan

- Update your personal resume

- Gather cash flow statements/documents & apply

Asset-Based Loan

What is it?

A loan that uses existing company assets as security

What are the pros?

- Ownership of existing assets is maintained as long as you remain in good standing

- Makes capital immediately available

- Enables purchasing flexibility

What are the cons?

- High interest rates

- Assets are forfeited if you default on payments

- Doesn’t immediately increase the value of the company

How do you get it?

- Identify the assets you will offer as collateral

- Apply with a lender

- Make a preliminary commitment

- Go through an asset audit

Get the JohnTalk “ALL-ACCESS PASS” & become a member for FREE!

Benefits Include: Subscription to JohnTalk Digital & Print Newsletters • JohnTalk Vault In-Depth Content • Full Access to the JohnTalk Classifieds & Ask a PRO Forum

Procurando levar seu negócio de banheiro portátil para o PRÓXIMO NÍVEL? Faça o download do nosso Guia GRATUITO: “Seu guia para operar um negócio de banheiro portátil”.

Pensando em entrar na indústria de banheiros portáteis? Baixe nosso Guia GRATUITO: “Seu guia para iniciar um negócio de banheiro portátil”.

How to Manage Capital Purchases

Bank Loan

What is it?

Funds loaned at interest by a bank for a certain period

What are the pros?

- Low, fixed interest rates

- Predictable monthly payments

- Helps build business credit

What are the cons?

- Lots of paperwork

- Long approval process

- Requires strong credit

How do you get it?

- Determine if you qualify

- Decide on the type of loan

- Compare lenders

- Gather documents & apply

Line of Credit (LOC)

What is it?

A flexible loan that consists of a defined amount of money that can be borrowed as needed

What are the pros?

- Funds can be accessed when needed

- Enables purchasing flexibility

- Helps build business credit

What are the cons?

- Qualifying can be difficult

- May come with a low borrowing limit

- Extra charges & fees can add up quickly

How do you get it?

- Review your credit score & finances

- Compare your options

- Check the requirements

- Calculate the costs

- Gather documents & apply

Commercial Real Estate Loan

What is it?

A mortgage secured by a lien on commercial property as opposed to residential property

What are the pros?

- Faster & easier approval process

- Shorter terms

- More room for negotiation

What are the cons?

- High interest rates

- Higher down payments and closing costs

- Not available to new investors

How do you get it?

- Identify a property & put it under contract

- Prepare your financial package

- Submit financial package for a quote

- Choose a loan product

- Due diligence & closing

Equipment Loan

What is it?

A loan used to purchase business-related equipment

What are the pros?

- No collateral requirement

- Flexible terms of repayment

- Total ownership of equipment once the loan is repaid

What are the cons?

- High interest rates

- Equipment could become obsolete or depreciate by the time the loan is paid off

- Usage is restricted to equipment

How do you get it?

- Review your credit score & finances

- Have a solid business plan

- Update your personal resume

- Gather cash flow statements/documents & apply

Asset-Based Loan

What is it?

A loan that uses existing company assets as security

What are the pros?

- Ownership of existing assets is maintained as long as you remain in good standing

- Makes capital immediately available

- Enables purchasing flexibility

What are the cons?

- High interest rates

- Assets are forfeited if you default on payments

- Doesn’t immediately increase the value of the company

How do you get it?

- Identify the assets you will offer as collateral

- Apply with a lender

- Make a preliminary commitment

- Go through an asset audit