Problemas con el transporte internacional

marzo 7, 2022

Costos crecientes en la fabricación de plástico

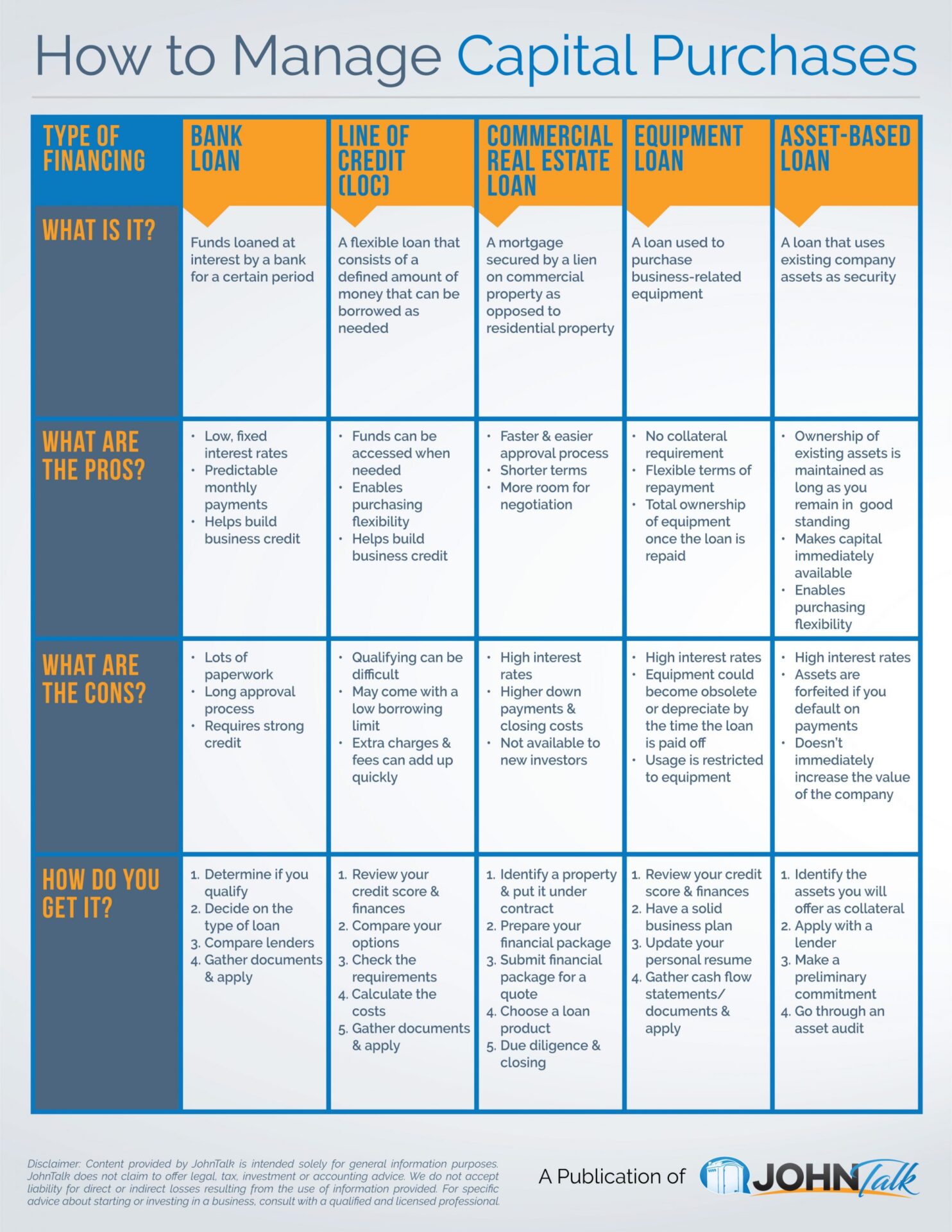

marzo 7, 2022A medida que construya y haga crecer su negocio de baños portátiles, deberá invertir en equipos: unidades, fregaderos, camiones, tal vez incluso terrenos y espacio de almacenamiento. Según el tamaño y la frecuencia de estas compras de capital, lo más probable es que utilice algún tipo de financiación.

¿Qué tipos de financiación están disponibles? ¿Qué opción u opciones tienen más sentido para su negocio? Estas son las preguntas que queremos ayudarte a responder. Es por eso que elaboramos esta infografía para que sirva como referencia mientras administra las compras de capital para su negocio.

¿Te gusta esta infografía? ¡Compártelo con tus amigos y colegas!

How to Manage Capital Purchases

Bank Loan

What is it?

Funds loaned at interest by a bank for a certain period

What are the pros?

- Low, fixed interest rates

- Predictable monthly payments

- Helps build business credit

What are the cons?

- Lots of paperwork

- Long approval process

- Requires strong credit

How do you get it?

- Determine if you qualify

- Decide on the type of loan

- Compare lenders

- Gather documents & apply

Line of Credit (LOC)

What is it?

A flexible loan that consists of a defined amount of money that can be borrowed as needed

What are the pros?

- Funds can be accessed when needed

- Enables purchasing flexibility

- Helps build business credit

What are the cons?

- Qualifying can be difficult

- May come with a low borrowing limit

- Extra charges & fees can add up quickly

How do you get it?

- Review your credit score & finances

- Compare your options

- Check the requirements

- Calculate the costs

- Gather documents & apply

Commercial Real Estate Loan

What is it?

A mortgage secured by a lien on commercial property as opposed to residential property

What are the pros?

- Faster & easier approval process

- Shorter terms

- More room for negotiation

What are the cons?

- High interest rates

- Higher down payments and closing costs

- Not available to new investors

How do you get it?

- Identify a property & put it under contract

- Prepare your financial package

- Submit financial package for a quote

- Choose a loan product

- Due diligence & closing

Equipment Loan

What is it?

A loan used to purchase business-related equipment

What are the pros?

- No collateral requirement

- Flexible terms of repayment

- Total ownership of equipment once the loan is repaid

What are the cons?

- High interest rates

- Equipment could become obsolete or depreciate by the time the loan is paid off

- Usage is restricted to equipment

How do you get it?

- Review your credit score & finances

- Have a solid business plan

- Update your personal resume

- Gather cash flow statements/documents & apply

Asset-Based Loan

What is it?

A loan that uses existing company assets as security

What are the pros?

- Ownership of existing assets is maintained as long as you remain in good standing

- Makes capital immediately available

- Enables purchasing flexibility

What are the cons?

- High interest rates

- Assets are forfeited if you default on payments

- Doesn’t immediately increase the value of the company

How do you get it?

- Identify the assets you will offer as collateral

- Apply with a lender

- Make a preliminary commitment

- Go through an asset audit

Get the JohnTalk «ALL-ACCESS PASS» & become a member for FREE!

Benefits Include: Subscription to JohnTalk Digital & Print Newsletters • JohnTalk Vault In-Depth Content • Full Access to the JohnTalk Classifieds & Ask a PRO Forum

¿Quiere llevar su negocio de baños portátiles al SIGUIENTE NIVEL? Descargue nuestra guía GRATUITA: «Su guía para operar un negocio de baños portátiles».

¿Está pensando en ENTRAR en la industria de los baños portátiles? Descargue nuestra guía GRATUITA: «Su guía para iniciar un negocio de baños portátiles».

How to Manage Capital Purchases

Bank Loan

What is it?

Funds loaned at interest by a bank for a certain period

What are the pros?

- Low, fixed interest rates

- Predictable monthly payments

- Helps build business credit

What are the cons?

- Lots of paperwork

- Long approval process

- Requires strong credit

How do you get it?

- Determine if you qualify

- Decide on the type of loan

- Compare lenders

- Gather documents & apply

Line of Credit (LOC)

What is it?

A flexible loan that consists of a defined amount of money that can be borrowed as needed

What are the pros?

- Funds can be accessed when needed

- Enables purchasing flexibility

- Helps build business credit

What are the cons?

- Qualifying can be difficult

- May come with a low borrowing limit

- Extra charges & fees can add up quickly

How do you get it?

- Review your credit score & finances

- Compare your options

- Check the requirements

- Calculate the costs

- Gather documents & apply

Commercial Real Estate Loan

What is it?

A mortgage secured by a lien on commercial property as opposed to residential property

What are the pros?

- Faster & easier approval process

- Shorter terms

- More room for negotiation

What are the cons?

- High interest rates

- Higher down payments and closing costs

- Not available to new investors

How do you get it?

- Identify a property & put it under contract

- Prepare your financial package

- Submit financial package for a quote

- Choose a loan product

- Due diligence & closing

Equipment Loan

What is it?

A loan used to purchase business-related equipment

What are the pros?

- No collateral requirement

- Flexible terms of repayment

- Total ownership of equipment once the loan is repaid

What are the cons?

- High interest rates

- Equipment could become obsolete or depreciate by the time the loan is paid off

- Usage is restricted to equipment

How do you get it?

- Review your credit score & finances

- Have a solid business plan

- Update your personal resume

- Gather cash flow statements/documents & apply

Asset-Based Loan

What is it?

A loan that uses existing company assets as security

What are the pros?

- Ownership of existing assets is maintained as long as you remain in good standing

- Makes capital immediately available

- Enables purchasing flexibility

What are the cons?

- High interest rates

- Assets are forfeited if you default on payments

- Doesn’t immediately increase the value of the company

How do you get it?

- Identify the assets you will offer as collateral

- Apply with a lender

- Make a preliminary commitment

- Go through an asset audit