Steigende Kosten in der Kunststoffherstellung

März 7, 2022

Erwartete Kraftstoffkostensteigerungen und wie sie sich auf Sie auswirken

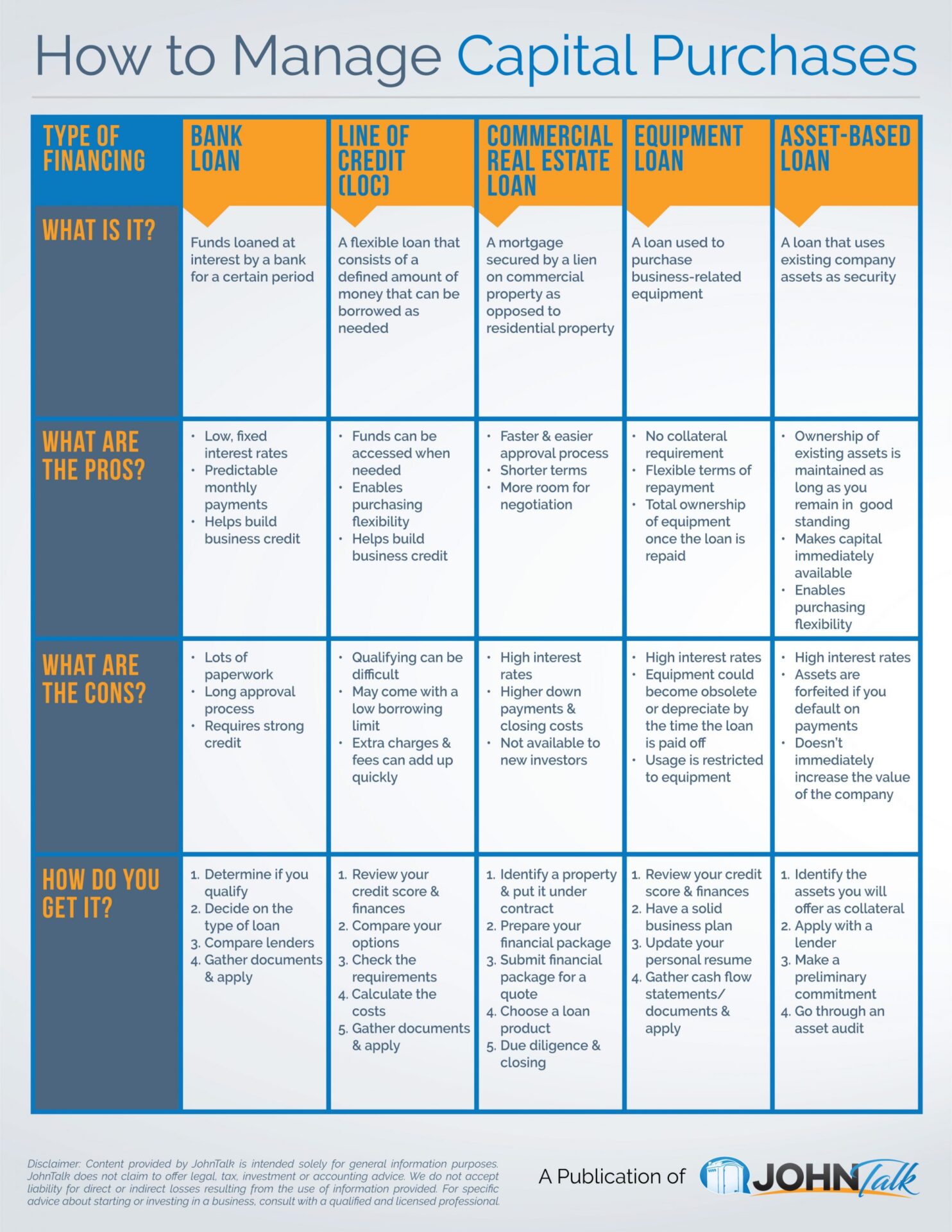

März 7, 2022Während Sie Ihr Geschäft mit tragbaren Toiletten aufbauen und ausbauen, müssen Sie in Ausrüstung investieren – Einheiten, Waschbecken, Lastwagen, vielleicht sogar Grundstücke und Lagerflächen. Abhängig von der Größe und Häufigkeit dieser Kapitalkäufe werden Sie höchstwahrscheinlich eine Art Finanzierung in Anspruch nehmen.

Welche Finanzierungsarten gibt es? Welche Option oder Optionen sind für Ihr Unternehmen am sinnvollsten? Das sind die Fragen, bei deren Beantwortung wir Ihnen helfen möchten. Aus diesem Grund haben wir diese Infografik zusammengestellt, die Ihnen als Referenz bei der Verwaltung von Kapitalkäufen für Ihr Unternehmen dienen soll.

Gefällt Ihnen diese Infografik? Teilen Sie es mit Ihren Freunden und Kollegen!

How to Manage Capital Purchases

Bank Loan

What is it?

Funds loaned at interest by a bank for a certain period

What are the pros?

- Low, fixed interest rates

- Predictable monthly payments

- Helps build business credit

What are the cons?

- Lots of paperwork

- Long approval process

- Requires strong credit

How do you get it?

- Determine if you qualify

- Decide on the type of loan

- Compare lenders

- Gather documents & apply

Line of Credit (LOC)

What is it?

A flexible loan that consists of a defined amount of money that can be borrowed as needed

What are the pros?

- Funds can be accessed when needed

- Enables purchasing flexibility

- Helps build business credit

What are the cons?

- Qualifying can be difficult

- May come with a low borrowing limit

- Extra charges & fees can add up quickly

How do you get it?

- Review your credit score & finances

- Compare your options

- Check the requirements

- Calculate the costs

- Gather documents & apply

Commercial Real Estate Loan

What is it?

A mortgage secured by a lien on commercial property as opposed to residential property

What are the pros?

- Faster & easier approval process

- Shorter terms

- More room for negotiation

What are the cons?

- High interest rates

- Higher down payments and closing costs

- Not available to new investors

How do you get it?

- Identify a property & put it under contract

- Prepare your financial package

- Submit financial package for a quote

- Choose a loan product

- Due diligence & closing

Equipment Loan

What is it?

A loan used to purchase business-related equipment

What are the pros?

- No collateral requirement

- Flexible terms of repayment

- Total ownership of equipment once the loan is repaid

What are the cons?

- High interest rates

- Equipment could become obsolete or depreciate by the time the loan is paid off

- Usage is restricted to equipment

How do you get it?

- Review your credit score & finances

- Have a solid business plan

- Update your personal resume

- Gather cash flow statements/documents & apply

Asset-Based Loan

What is it?

A loan that uses existing company assets as security

What are the pros?

- Ownership of existing assets is maintained as long as you remain in good standing

- Makes capital immediately available

- Enables purchasing flexibility

What are the cons?

- High interest rates

- Assets are forfeited if you default on payments

- Doesn’t immediately increase the value of the company

How do you get it?

- Identify the assets you will offer as collateral

- Apply with a lender

- Make a preliminary commitment

- Go through an asset audit

Get the JohnTalk „ALL-ACCESS PASS“ & become a member for FREE!

Benefits Include: Subscription to JohnTalk Digital & Print Newsletters • JohnTalk Vault In-Depth Content • Full Access to the JohnTalk Classifieds & Ask a PRO Forum

Möchten Sie Ihr Geschäft mit tragbaren Toiletten auf die nächste Stufe bringen? Laden Sie unseren KOSTENLOSEN Leitfaden herunter: „Ihr Leitfaden für den Betrieb eines Geschäfts mit tragbaren Toiletten.“

Denken Sie darüber nach, in die Industrie der tragbaren Toiletten einzusteigen? Laden Sie unseren KOSTENLOSEN Leitfaden herunter: „Ihr Leitfaden zum Start eines Geschäfts mit tragbaren Toiletten.“

How to Manage Capital Purchases

Bank Loan

What is it?

Funds loaned at interest by a bank for a certain period

What are the pros?

- Low, fixed interest rates

- Predictable monthly payments

- Helps build business credit

What are the cons?

- Lots of paperwork

- Long approval process

- Requires strong credit

How do you get it?

- Determine if you qualify

- Decide on the type of loan

- Compare lenders

- Gather documents & apply

Line of Credit (LOC)

What is it?

A flexible loan that consists of a defined amount of money that can be borrowed as needed

What are the pros?

- Funds can be accessed when needed

- Enables purchasing flexibility

- Helps build business credit

What are the cons?

- Qualifying can be difficult

- May come with a low borrowing limit

- Extra charges & fees can add up quickly

How do you get it?

- Review your credit score & finances

- Compare your options

- Check the requirements

- Calculate the costs

- Gather documents & apply

Commercial Real Estate Loan

What is it?

A mortgage secured by a lien on commercial property as opposed to residential property

What are the pros?

- Faster & easier approval process

- Shorter terms

- More room for negotiation

What are the cons?

- High interest rates

- Higher down payments and closing costs

- Not available to new investors

How do you get it?

- Identify a property & put it under contract

- Prepare your financial package

- Submit financial package for a quote

- Choose a loan product

- Due diligence & closing

Equipment Loan

What is it?

A loan used to purchase business-related equipment

What are the pros?

- No collateral requirement

- Flexible terms of repayment

- Total ownership of equipment once the loan is repaid

What are the cons?

- High interest rates

- Equipment could become obsolete or depreciate by the time the loan is paid off

- Usage is restricted to equipment

How do you get it?

- Review your credit score & finances

- Have a solid business plan

- Update your personal resume

- Gather cash flow statements/documents & apply

Asset-Based Loan

What is it?

A loan that uses existing company assets as security

What are the pros?

- Ownership of existing assets is maintained as long as you remain in good standing

- Makes capital immediately available

- Enables purchasing flexibility

What are the cons?

- High interest rates

- Assets are forfeited if you default on payments

- Doesn’t immediately increase the value of the company

How do you get it?

- Identify the assets you will offer as collateral

- Apply with a lender

- Make a preliminary commitment

- Go through an asset audit