How to Save on Ordering Supplies

April 9, 2018

What to Do If Someone Isn’t Paying You

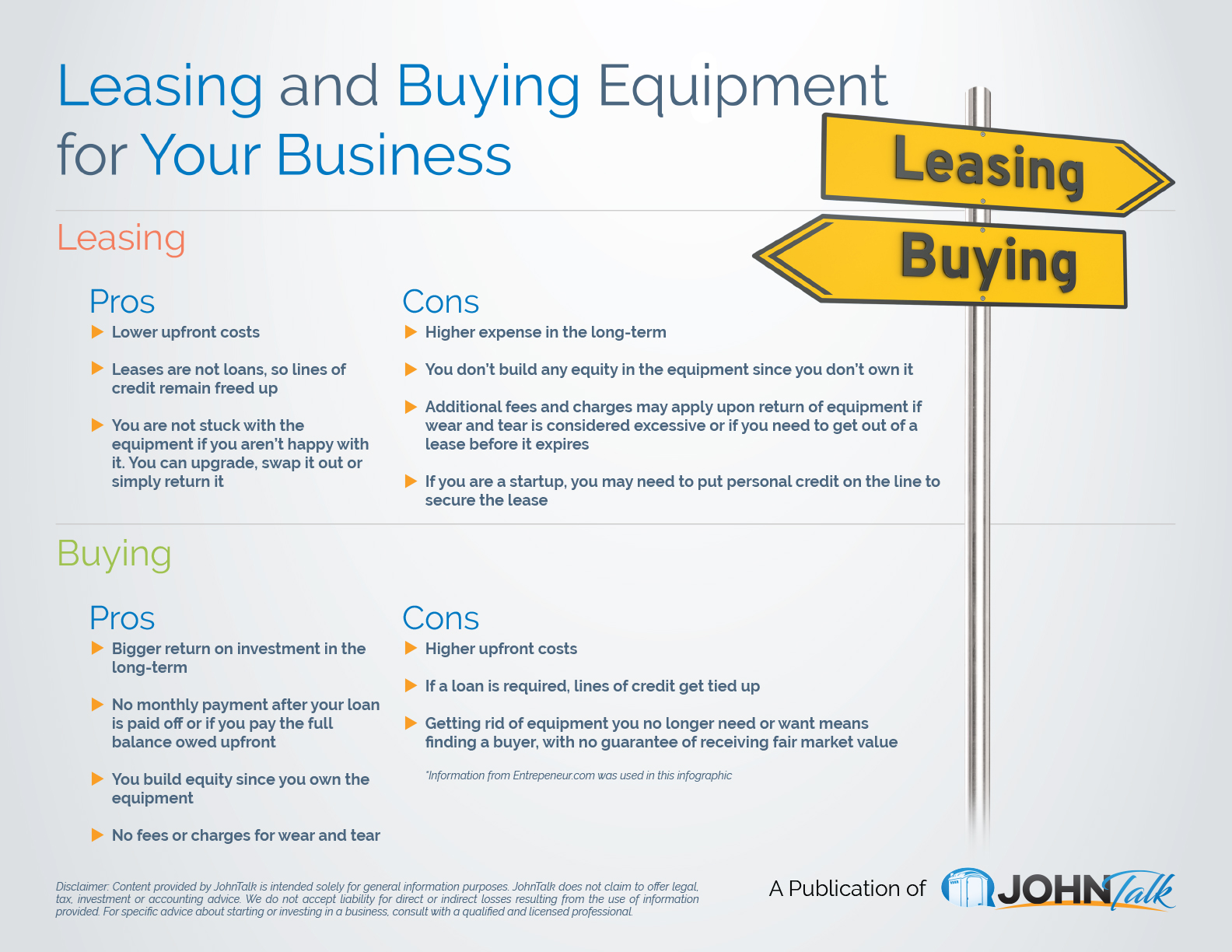

April 20, 2018As with any business, you can lease the equipment you need for your portable restroom operation instead of buying it. When you lease equipment, you are “renting” it for a flat monthly rate for a specified amount of time. When the lease is up, you have the option to purchase the equipment for its fair market value, continue leasing or return it. Depending on your business situation, there are aspects of leasing you may find appealing. But there are also situations where it may make more sense to just buy the equipment. Here are some aspects of leasing and buying for you to consider:

Like this infographic? Share it with your friends and colleagues!

Get the JohnTalk “ALL-ACCESS PASS” & become a member for FREE!

Benefits Include: Subscription to JohnTalk Digital & Print Newsletters • JohnTalk Vault In-Depth Content • Full Access to the JohnTalk Classifieds & Ask a PRO Forum

Looking to Take Your Portable Restroom Business to the NEXT LEVEL? Download our FREE Guide: “Your Guide to Operating A Portable Restroom Business.”

Thinking About GETTING INTO the Portable Restroom Industry? Download our FREE Guide: “Your Guide to Starting A Portable Restroom Business.”

Leasing and Buying Equipment for Your Business

Leasing

Pros

- Lower upfront costs

- Leases are not loans, so lines of credit remain freed up

- You are not stuck with the equipment if you aren’t happy with it. You can upgrade, swap it out or simply return it

Cons

- Higher expense in the long-term

- You don’t build any equity in the equipment since you don’t own it

- Additional fees and charges may apply upon return of equipment if wear and tear is considered excessive or if you need to get out of a lease before it expires

- If you are a startup, you may need to put personal credit on the line to secure the lease

Buying

Pros

- Bigger return on investment in the long-term

- No monthly payment after your loan is paid off or if you pay the full balance owed upfront

- You build equity since you own the equipment

- No fees or charges for wear and tear

Cons

- Higher upfront costs

- If a loan is required, lines of credit get tied up

- Getting rid of equipment you no longer need or want means finding a buyer, with no guarantee of receiving fair market value

* Information from Entrepreneur.com was used in this infographic