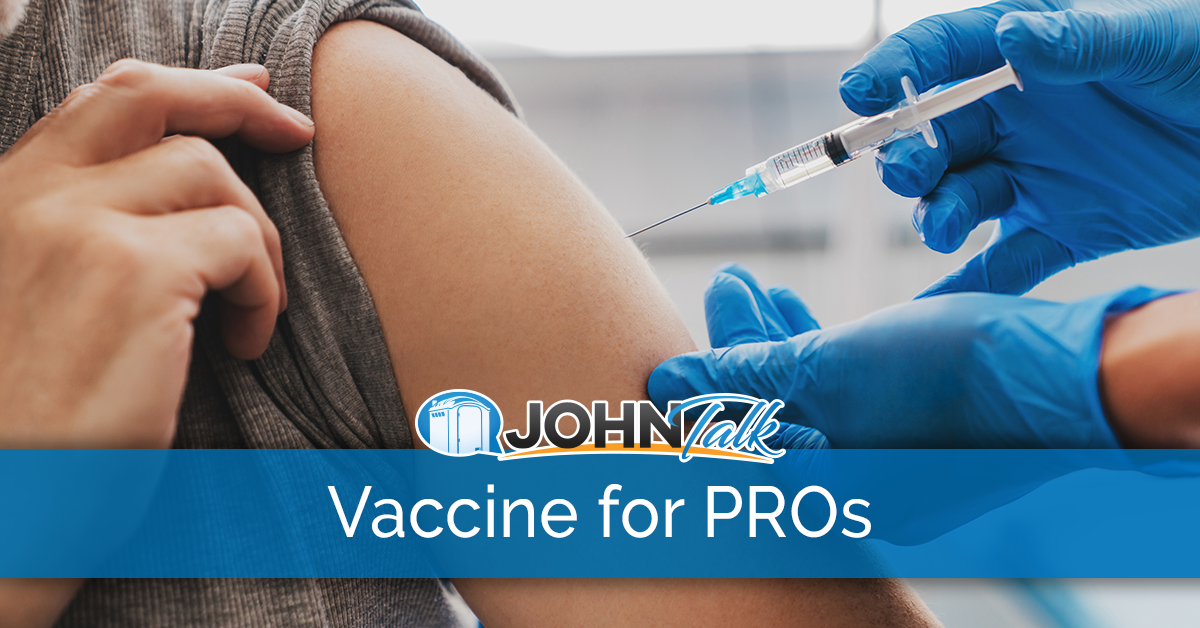

Vaccine Rollout: When Do US Pumpers Get a Shot?

March 8, 2021

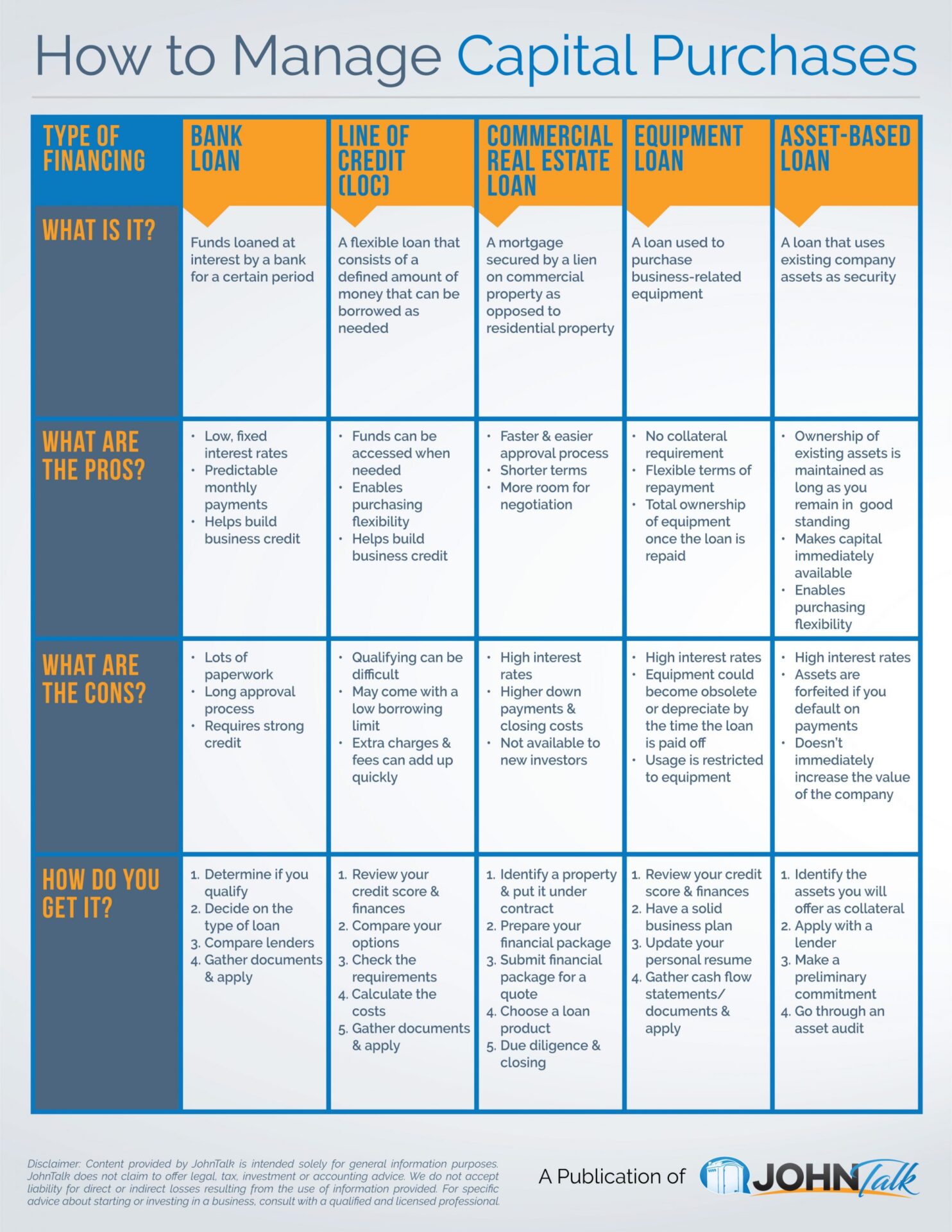

INFOGRAPHIC: How to Manage Capital Purchases

March 22, 2021If you still require your customers to fill out a form to pay you or if you’re relying on cash or checks as payment, you may be losing business. You are also getting paid a lot slower than you could be.

Nowadays, many people prefer paying with their cards. This can seem tricky for businesses that still wish to accept older forms of payment. At one time, accepting electronic payments was expensive and cumbersome. Luckily, it has become a whole lot easier in recent years, with different companies offering great, easy-to-set-up, and cheaper services.

This article provides an overview of electronic payments and how they work. If you decide it makes sense for your business, you’ll have the foundational knowledge to get set up and modernize your business.

What Options Do I Have?

There are many companies offering card readers and programs which allow you to accept payments either in-person or over the phone. The most popular ones are:

- Square: Fast setup and no commitment, so you can cancel anytime. Square charges 2.6% + 10¢ per card transaction and 5% + 15¢ per over-the-phone transaction. Their card readers range from $10 for a swipe reader, $49 for a contactless and chip reader, and $169 for an iPad-compatible reader.

- Stripe: Stripe charges 2.7% + 5¢ per card transaction and 2.9% + 30¢ per over-the-phone transaction. Their card readers range from $59 to $299.

- Payanywhere: Offering mobile and storefront card readers, Payanywhere charges 2.69% per card transaction and 49% + 19¢ per over-the-phone transaction. They have flexible card reader payment options starting at $49.95.

- PayPal: Many businesses use PayPal to take online payments, but they also provide card readers. They charge 2.7% per card transaction and 3.5% + 15¢ per over-the-phone transaction. Their card readers range from $24.99 to $79.99.

Get the JohnTalk “ALL-ACCESS PASS” & become a member for FREE!

Benefits Include: Subscription to JohnTalk Digital & Print Newsletters • JohnTalk Vault In-Depth Content • Full Access to the JohnTalk Classifieds & Ask a PRO ForumClick here to learn more.

How Can I Accept Electronic Payments?

With all of the options above, you’ll be able to tailor how you can take card payments, choosing:

- A card reader in your shop that swipes, taps, or takes chip cards.

- Payment over the phone by keying a person’s card details into the reader, which saves the transaction securely.

- Cell phone-compatible readers for your drivers so they can accept payments in the field. Some even work without internet connectivity, so make sure to ask about this before you buy.

- iPad-compatible readers if you think your staff is savvy enough to use them.

Talk to Your Staff

You may know what level of tech knowledge your staff has, or you may need to find out. Some may surprise you with how much they know – lots of people already have tablets and smartphones they use every day. Others may feel uncomfortable using them, so it may require a bit of training. You may also decide to keep things as simple as you can.

Whatever you decide to do, you shouldn’t consider accepting electronic payments a burden. Card payments will actually make getting paid faster, which can only help your business. It makes it quicker and easier for your customers, too. Once it’s set up, you won’t look back.

Looking to Take Your Portable Restroom Business to the NEXT LEVEL? Download our FREE Guide: “Your Guide to Operating A Portable Restroom Business.”

Thinking About GETTING INTO the Portable Restroom Industry? Download our FREE Guide: “Your Guide to Starting A Portable Restroom Business.”