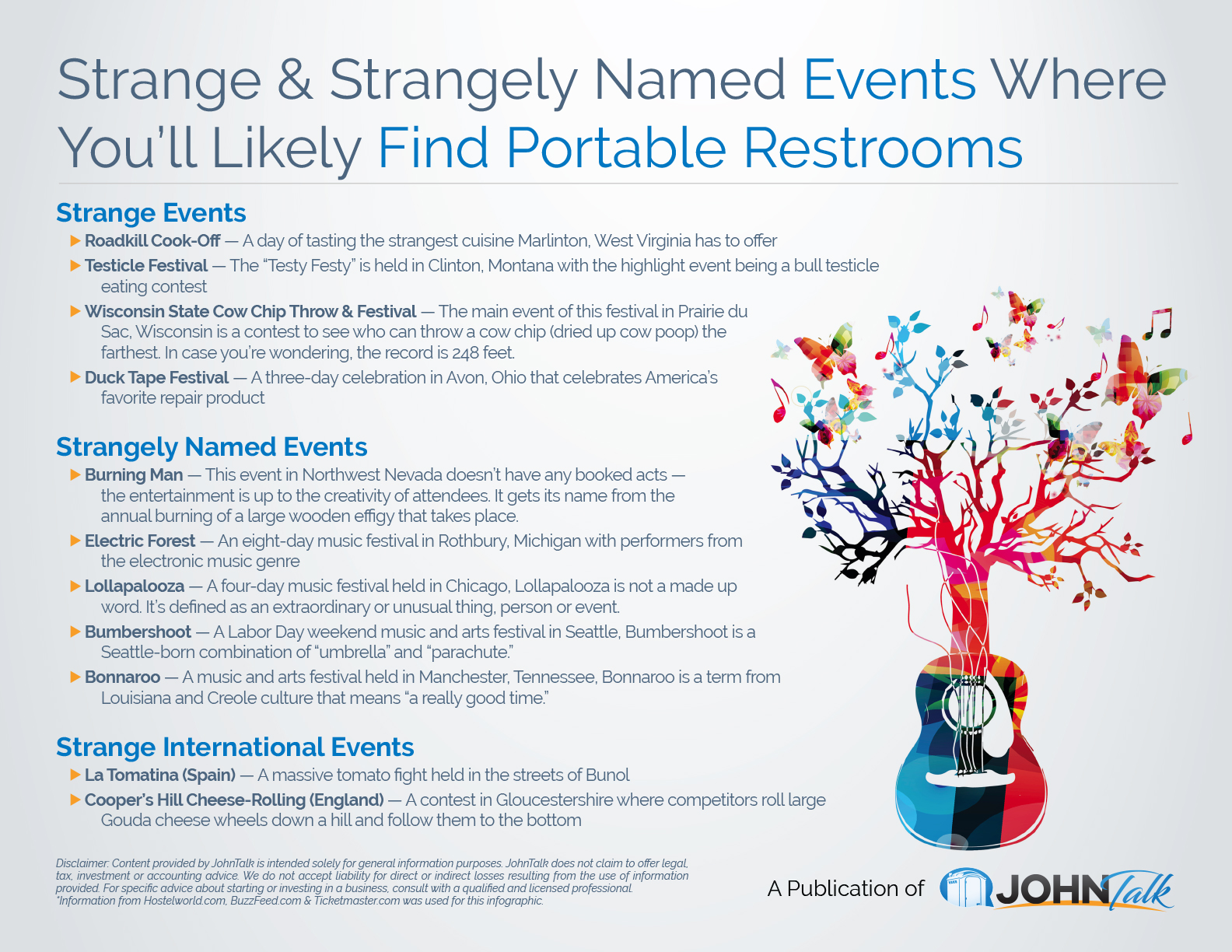

INFOGRAPHIC: Strange & Strangely Named Events Where You’ll Likely Find Portable Restrooms

September 24, 2018

Dealing with the Effects of Storms

October 1, 2018For one-off events, the majority of portable restroom operators require payment in full before delivery. However, PROs catering to businesses extend credit with the promise of long-term contracts. This act of goodwill makes it easier to secure new clients, as trust is a crucial component of fantastic customer service. However, maintaining your accounts receivable is risky. Successful businesses incorporate policies that limit credit risk and ensure new accounts are credit-worthy. Consider the facts to determine if you should check the credit scores of new accounts or impose credit limits:

Reasons PROs Extend Credit

Portable restroom operators suggest that business growth is a top reason for extending credit. Operators, who are in a financial position to offer alternate payment plans, cite several reasons for providing credit to business accounts.

- Attract new customers. New customers boost revenue which, in turn, helps your bottom line. Businesses build their customer base by extending credit.

- Increase sales. People using credit are more likely to purchase add-ons. PROs choose specific clients with excellent credit and offer add-on items to enhance the guest experience.

- Build loyalty. PROs know that repeat business stems from loyal customers. Extending credit provides a level of trust and certainty that keeps clients coming back.

- Boost reputation. Businesses want to work with companies with a solid reputation. By offering credit, you’re demonstrating confidence in your company’s future.

Assess Your Financials to Determine Limits

Start by determining the amount of risk that your business can take. You need to weigh the positive impact on sales by offering credit versus the worst-case scenario of non-payment. Each new assessment needs to start with the PRO figuring out if their financial position can handle additional risk.

Review existing sales and contracts to determine what the average customer spends. You should extend enough credit for a new account to use your products and services, but not more than you can safely cover. Check out your competitors’ payment options, but use your financial statements to determine your risk.

Many businesses aren’t in a position to offer unlimited credit to new accounts. PROs mitigate risk by writing credit policies that meet their long-term goals.

Get the JohnTalk “ALL-ACCESS PASS” & become a member for FREE!

Benefits Include: Subscription to JohnTalk Digital & Print Newsletters • JohnTalk Vault In-Depth Content • Full Access to the JohnTalk Classifieds & Ask a PRO Forum

Check Credit Scores as Part of Your Policy

New accounts aren’t easy to come by or replace. Have a clear plan in place that ensures your actions deliver results. Minimize risk by reviewing a new customer’s background before offering a significant amount of credit. Inquire about a company’s financial stability by looking at:

- Credit reports: Financial sites like Dun & Bradstreet or Experian offer business background and credit checks. Prices range from $60 and up per report.

- Credit references or financial statements: Standard legal forms can help businesses determine liability.

- Research online: A quick Google search helps PROs determine creditworthiness. Press releases promoting new services are a sign of business growth. Newspaper articles talking about company layoffs are a reason for concern.

Depending on your company’s needs, you may go with a conservative or liberal credit policy. Entrepreneur suggests that “if your customers are in “soft” industries such as construction…you would do well to use a conservative policy.” Operators enable growth by making decisions that increase sales and adequately vet new accounts.

The decision to extend credit, check credit scores, and impose limits requires careful consideration. Experts in the portable restroom industry suggest using due diligence when extending credit to new accounts. PROs that are thorough in their financial reviews and credit assessment lesson risk while growing their revenue.

Looking to Take Your Portable Restroom Business to the NEXT LEVEL? Download our FREE Guide: “Your Guide to Operating A Portable Restroom Business.”

Thinking About GETTING INTO the Portable Restroom Industry? Download our FREE Guide: “Your Guide to Starting A Portable Restroom Business.”