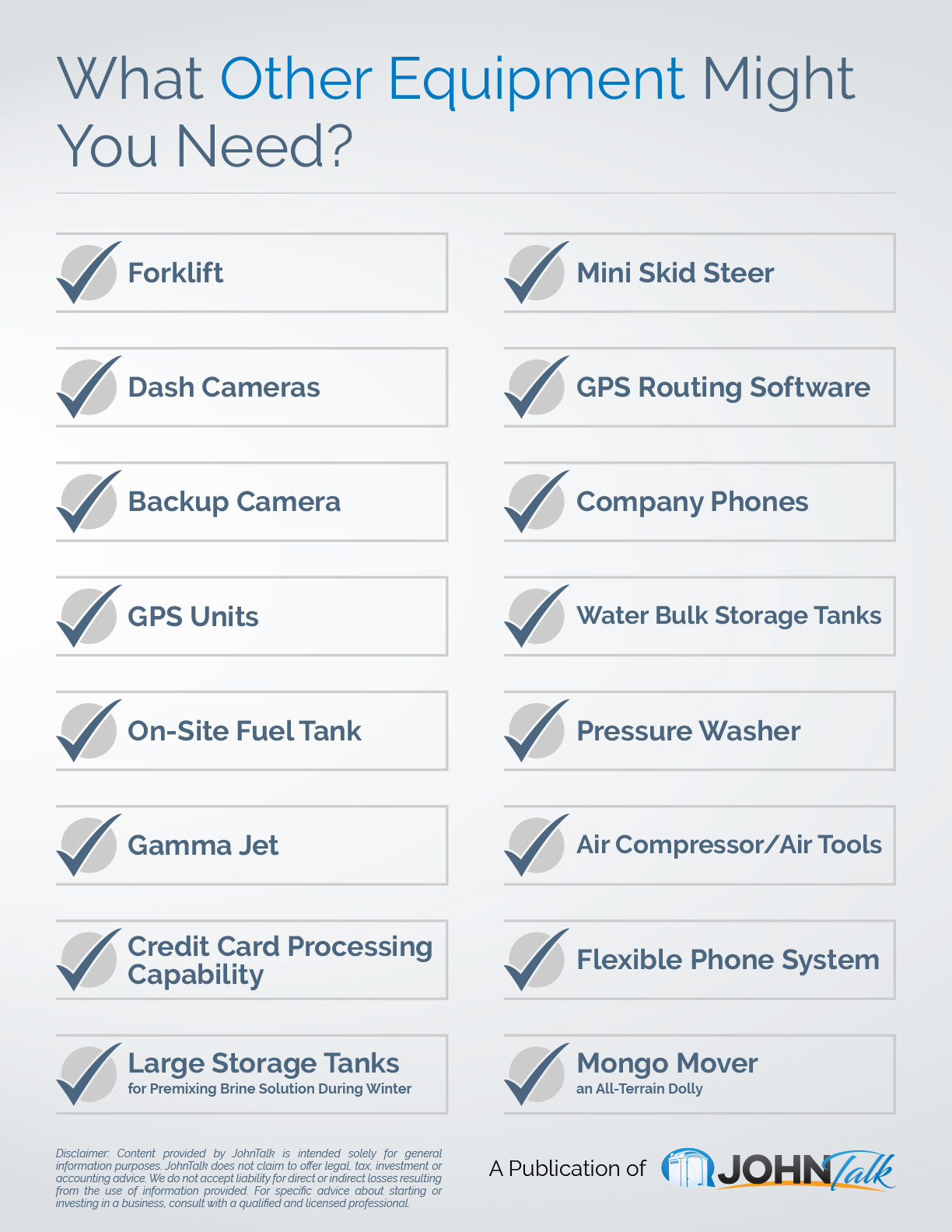

INFOGRAPHIC: What Other Equipment Might You Need?

April 20, 2018

The ELD Mandate: What Does It Mean for You?

April 23, 2018One of the great joys of owning your own portable sanitation business is that it’s your business. You build it from the ground up. You earn your own success. You make your own decisions. You are recognized and respected in your local business community and in your industry. You are your own boss, and it’s your vision that propels the company forward.

Owning your own business can offer financial security and help you and your family have a good life. It’s how you pay the bills, put the kids through school, take vacations, and save for a well-deserved retirement. Your business becomes a valuable asset. It’s worth a lot of money.

There’s also a special sense of pride that comes from your business when your children become involved. They may start by helping out after school, then working during the summer. They become adults who assume major responsibilities in the business. Often, their significant others become trusted members of the team.

When you look into the future to see all the wonderful things you hope will come to pass in your business, do you ever imagine your business without you? How do you see your business after you retire? How do you see it if a situation prevents you from working tomorrow?

According to the Small Business Association (“Business Succession Planning”), in the next 10 to 15 years approximately 70% of privately owned businesses, worth an estimated $10 trillion, will be transferred to the next generation.

Some of these businesses will continue to grow, thrive and be valuable. But some will be sold for a loss, while others will simply shut down and sell their assets. In many instances, the difference will be how well the owner has planned ahead to make the transfer.

The process of transferring ownership and leadership of a company is called business succession planning.

For owners of portable sanitation businesses who want their legacy to continue, succession planning should be the foundation of their efforts. Financial experts advise business owners at any stage to have a succession plan in place sooner rather than later. As the SBA says, business succession planning is not an event, but a long-term process.

The Business of Succession

The SBA says that business succession planning is not something you do by yourself. Partner with the experts, including:

- Your banker

- Your attorney

- Your accountant

- A business consultant with experience in business succession

If you don’t have a business mentor, contact SCORE at https://www.score.org/. SCORE is the nation’s largest network of volunteer, expert business mentors, and is a resource partner of the SBA. Their services are free and confidential.

The SBA recommends that you begin with a financial health check of your business. This is an important first step, especially if you are considering selling your business as part of your succession plan. A profitable business is easier to sell, and it’s also easier for a buyer to obtain financing. Through SCORE, you can find a local Small Business Development Center (SBDC) counselor who can help you perform your financial health check.

For an overview, see the SBA guide “Selling a Small Business and Succession Planning for a Small Business” at https://www.sba.gov/sites/default/files/files/PARTICIPANT_GUIDE_SELLING_SUCCESSION_PLANNING.pdf and accompanying PowerPoint at https://www.sba.gov/sites/default/files/articles/MSSB_Selling_Succession_Slides.pptx.

When Family and Business are Inseparable

For the family-owned business, succession affects your business, but it also affects your family.

Because in every family business, the two critical dynamics of family and business are equally important and inseparable.

When a company has been doing things the same way for years, business succession can involve some difficult decisions. Change can be even harder if the status quo means the business has outgrown the structure and people that it relied upon for many years. A good example is when a business founder holds on to the reins of leadership too long and won’t pass control to his or her children.

But with challenge comes opportunity. Your goal is to make a change that will bring a more profitable business and a happier family.

In the succession planning process, family business owners must ask the most important questions of their lives, understanding that these two dynamics affect the multi-generational vision they have for their business… and family:

- What do you want for the future of your business?

- What do you want for your children working in the business?

- What results do you want from your family’s ownership in the future?

- What does ownership mean for the health of your family?

- What do your children want?

How well do you know what you and other members of your family really feel about the business? Have every member of your family take the following critical assessment. Mark each question or statement with a 1 if it is important to you and needs to be addressed. Put a 0 for each that is not important or has already been discussed and resolved. Then compare and discuss your responses. This exercise will help you have the critical conversations with your family that are needed to help strengthen your business relationships with them.

(1 — important and needs to be addressed, 0 — not important and/or resolved)

- ___ Every family member in the business is committed to the future of our family business.

- ___ Are family members obligated to work for the business indefinitely, or may they pursue other careers?

- ___ Do we (the owners) want to continue owning the business indefinitely or should we eventually sell it?

- ___ How do we decide which family members will be employed by the company?

- ___ Must we offer every family member a job?

- ___ Should in-laws or other relatives be invited to work in the business?

- ___ What education or work preparation should be required of family members who work in the business?

- ___ How do we assign titles and work responsibility?

- ___ How should we evaluate and pay family members who work in the business?

- ___ What should we do if a family member doesn’t perform or leaves the business?

- ___ How and when do we select the next leader of the company?

- ___ When and how should leadership transition take place?

- ___ How do we evaluate our new leader’s job performance?

- ___ How do we provide meaningful careers for other family members who are not chosen to lead?

- ___ Who should serve on our board of directors? Family members? Employees? Outside advisors? Others?

- ___ How should our board of directors function and what should we expect of them?

- ___ Who should own stock in the business?

- ___ Should all children own equally, whether or not they work in the business?

- ___ What dividends or prerequisites (perks) should shareholders receive?

- ___ How do we balance the interests of inside family shareholders (who work in the business) with interests of outside family shareholders (who don’t work in the business)?

- ___ What should we do if a family shareholder wants to sell out?

- ___ How should we deal with family disagreements? Between individuals? Between members of the same or different generation?

- ___ How do we teach in-laws and younger family members about the values and traditions of our business and our family?

- ___ Who will lead family activities in the next generation?

- ___ How do we help family members who are in financial distress?

- ___ What other responsibilities do we have to other family members?

- ___ What do we do if there is a divorce in the family?

- ___ What if a family member breaks the law or is seriously irresponsible?

- ___ How do we support family members in their own business ventures?

- ___ How do we protect the contributions of unrelated, key employees?

- ___ To what extent do we involve key employees in family disagreements?

- ___ What obligations do we have to prized employees?

- ___ Should key employees own stock in our family business?

- ___ Might one key employee be the next leader of our business?

- ___ How do we treat loyal employees whose productivity or value the company has declined?

- ___ What are our responsibilities to the community?

- ___ How do we cope with our public image and the public’s expectations of us during and after the transfer?

(Source: Le Van, The Survival Guide for Business Families, Routledge, 1999)

Get the JohnTalk “ALL-ACCESS PASS” & become a member for FREE!

Benefits Include: Subscription to JohnTalk Digital & Print Newsletters • JohnTalk Vault In-Depth Content • Full Access to the JohnTalk Classifieds & Ask a PRO Forum

Start with Trust

In order to enjoy success in your succession efforts, you must first understand your business success.

What do successful family businesses have most in common? Trust.

Trust is the most important ingredient to their success. The relationships between family members, employees, customers, and suppliers are built on trust. In fact, trust is the relationship. We say that businesses “lead from trust.”

What is trust, and how is it developed? We trust someone based on that person’s character and competence.

Character comes from your intentions (what you say) and the actions you take to fulfill those intentions (what you do). It means you tell people who you are and what the business stands for based on how you “talk the talk” and “walk the walk.”

Competence comes from your capabilities and the results you achieve with those capabilities. Nothing builds trust better than results, and the result we want most in business is success. Competencies typically include a stack of elements which, when developed, help you get the desired results proficiently. It is also important to transfer this stack of elements to the next generation. We call this grouping “Competency STAKs” which include the following elements:

- Skills

- Tasks

- Abilities/Attitude

- Knowledge

Trust is built intentionally. It doesn’t derive from just a title or family ownership. Keep trust topmost in your mind as you make the important decisions that guide your business succession process.

Set Up the Family Business to Thrive

We use the word “thrive” to describe the aim of having both a profitable business and a happy family. This is the best outcome when balancing the two equal and inseparable elements of the family business.

Thrive is the optimal experience of performance, growth, and value. Thrive is the personal reward we gain by creating the family business culture we envision. Thrive means you are making the good decisions to improve your situation at work and in your personal life.

To thrive, you need to know what matters most in your:

- Family life

- Business life

- Financial life

Thrive by Asking Honest Questions

Understand that your work and personal life will be filled with tough choices. By asking honest questions about them, you can better determine your vision for succession.

Even when you own a successful portable sanitation business, you will find that your financial goals, business goals, career goals, and personal dreams are not always in sync. To complicate things further, these goals may be constantly changing. For example, your retirement goals may be interrupted by an unexpected illness or injury.

Also, your goals are probably not the same goals that other members of your family have.

To measure your work and business “wellness,” ask yourself these questions. Family members involved in the business should also ask themselves. Compare your answers.

- What important decisions are you avoiding?

- Do you feel as though you’re missing something? What?

- What decisions have you made that you’ve regretted – and then repeated?

- Does talking about work and life with loved ones make you feel uncomfortable, or provoke a negative response? Identify the reasons why.

Thrive by Making Good Choices

Your work and personal life are determined by how you make choices. Learn to make well-informed decisions during your succession planning process.

Lack of clarity and understanding of yourself (in particular, what is of value to you) and the situation will lead to poor business succession decisions. Making good decisions requires you to be honest, disciplined, and persistent.

Use the following steps, called the Five I’s, to make informed and objective decisions that will maximize your business succession planning, especially when money is involved (or any major business decision).

The Five I’s

- Issue

What are you concerned about? What are you uncertain of and want to get a better handle on? What’s not working from your perspective? What opportunities are there that you don’t want to miss out on or would like to take advantage of? Identify the issue.

- Impact

What impact is this issue having on your family business, family, or finances? What will be the impact if nothing is done? Identify the impact.

- Importance

How important is this issue to you, your family, the business? How would you rate the importance? On a scale from 0 to 10, 0 not really important at and 10 most Important of All. Identify the importance.

- Immediacy

When do you need and/or want to deal with this issue? Immediately, 6 months from now, etc. Identify the immediacy.

- Implementation

What is the step that needs to be taken first? Who needs to be involved? What support do you need? Who should be involved? Set action in motion. Start implementation.

Remember, important family business issues usually affect others. Get them involved.

- Each person reviews the 5 I’s and notes their perspective

- Participants take turns sharing their perspective

- Each person asks clarifying questions

- Jointly quantify the costs involved, if any

- Jointly quantify the benefits involved, if any

- Determine whether you have the assets, resources, and skills required; if not, make a plan to address this

- Come to a mutual agreement regarding actions

- Confirm that you have a plan and commit to following up (pick a date) and moving forward

- Finally, keep everyone involved by communicating results and progress

Get Started Now

Many a portable sanitation business owner has gotten through a difficult workday by looking forward to the time when they can kick back and enjoy life while proudly watching the next generation take control. It’s great incentive to not only work for today, but to plan for tomorrow.

Just as every family is different, every business succession plan will be unique. But with a better understanding and effort toward success, trust, and thriving, your business succession plan will have a solid foundation on which to build.

Here are a few final tips when considering your plans. It’s not legal guidance, just common-sense suggestions. Always seek expert legal advice!

- Leave taxes, estate planning, and financial planning to proven professionals, BUT CHALLENGE EVERYTHING. Have an outsider review. Ask smart questions.

- Help build your children’s credit score and money-handling skills

- Make sure children understand the business

- Make sure children, when ready, understand the family financials (review with CPA or accountant)

- If necessary, have an outside expert assess your family employees’ character, competencies, and potential

- Seek family counseling or mediation for unresolved issues

- Commit to a business succession plan being done and declare the end date for the plan to be complete

- Keep employees out of it until you have a plan and have done the evaluation

- Cash is King. Maximize your family wealth! Once the cash flow is gone, it’s gone.

By Kelly Newcomb, MA, BSCMP

Kelly Newcomb has presented succession planning information to PROs for 20 years.

Looking to Take Your Portable Restroom Business to the NEXT LEVEL? Download our FREE Guide: “Your Guide to Operating A Portable Restroom Business.”

Thinking About GETTING INTO the Portable Restroom Industry? Download our FREE Guide: “Your Guide to Starting A Portable Restroom Business.”